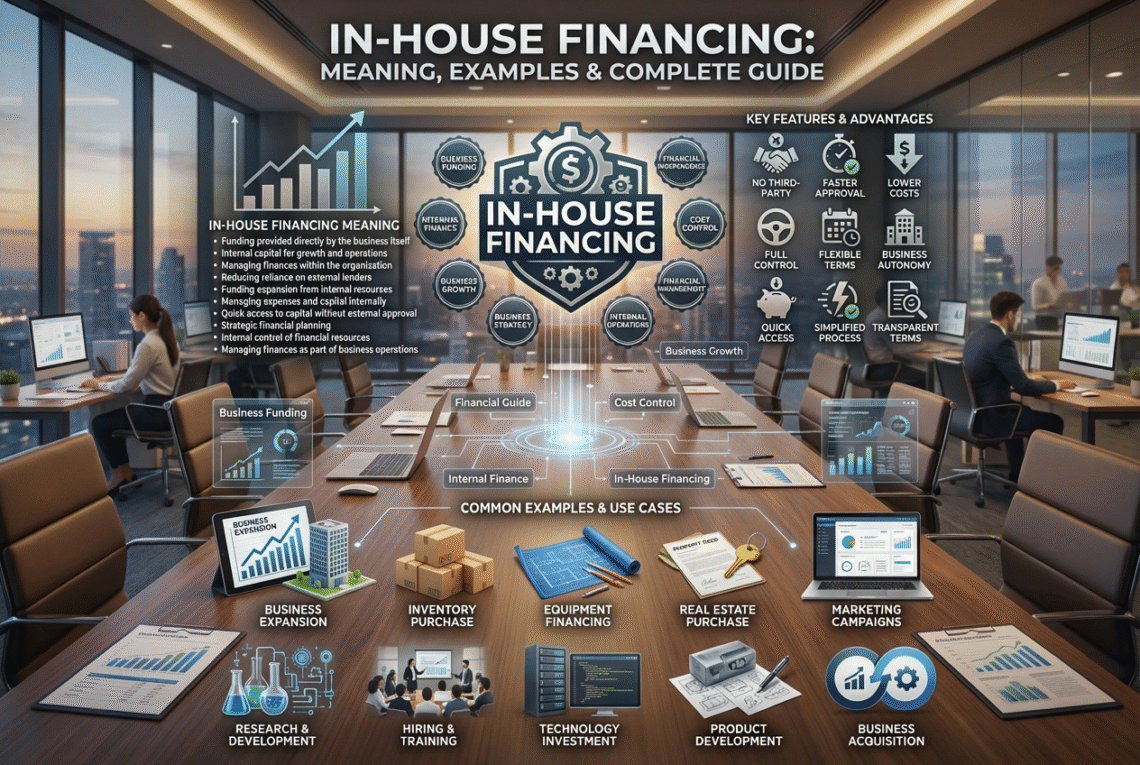

In‑house financing is a credit solution where a business provides loans directly to its customers instead of involving banks or third‑party lenders. The company acts as the lender, allowing buyers to purchase goods or services and pay in installments under terms set by the seller.

This model is common in industries with automotive sales, healthcare, retail appliances, home renovation, and education, where upfront costs are high. By offering flexible repayment options, businesses make expensive products more accessible, increase conversion rates, and build stronger customer loyalty.

Unlike traditional loans, in‑house financing often delivers faster approvals, simpler requirements, and personalized terms. Many businesses now rely on in‑house financing software to automate credit scoring, loan servicing, and compliance, ensuring a seamless process for both the company and the customer.

Whether you explore cars in‑house financing, review in‑house financing requirements, or apply for in‑house financing online, this approach removes financial barriers and empowers customers to buy with confidence.

What Is In-House Financing?

In-house financing refers to credit provided directly by a retailer, dealer, or service provider. Instead of relying on banks or third-party lenders, the business itself acts as the lender. Customers can purchase and finance goods or services at the same point of sale, making the process faster and more convenient.

This model is common in industries with high-ticket purchases such as automotive sales, medical services, retail appliances, and home improvement projects. By offering flexible payment plans, businesses increase affordability, boost sales, and build stronger customer loyalty.

What Is the Meaning of In-House Financing?

The meaning of in-house financing is simple: the seller provides the loan. Customers apply directly at the store or dealership, and repayment terms are managed internally. Unlike traditional loans, approval is often quicker, and requirements may be more flexible.

How Does In-House Financing Work?

- The customer applies for financing at the point of sale.

- Business evaluates creditworthiness using internal checks or in-house financing software.

- Loan terms are set, including down payment, interest rate, and repayment schedule.

- The customer pays installments directly to the business.

Digital in-house financing platforms automate credit scoring, loan servicing, and compliance, making the process seamless.

What Are the Benefits of In-House Financing?

- Faster approvals compared to banks.

- Flexible requirements, often accepting customers with lower credit scores.

- Higher sales conversion, as customers can buy immediately.

- Customer loyalty, since financing is tied to the retailer.

- No third-party fees, keeping profits within the business.

Industry reports show that companies offering in-house financing close 10–30% more sales than those relying only on upfront payments.

In-House Financing Example

A car dealership offers car in-house financing. Instead of sending the buyer to a bank, the dealer provides a loan directly. The customer pays monthly installments to the dealership. This allows the dealer to close more deals, especially for buyers who may not qualify for traditional bank loans.

In-House Financing vs Bank Financing

- Approval Speed: In-house financing is faster, while banks may take days.

- Flexibility: Dealers or retailers often accept lower credit scores. Banks require stricter checks.

- Interest Rates: Banks may offer lower rates, while in-house loans can include markups.

- Customer Experience: In-house financing integrates with the purchase process, while banks require separate applications.

In-House Financing Requirements

Requirements vary by industry but usually include:

- Proof of income.

- Identification documents.

- Down payment (optional).

- Agreement to repayment terms.

Many businesses use in-house financing calculators to help customers estimate monthly payments before signing contracts.

In-House Financing Software and Online Options

Modern businesses rely on in-house financing software to automate loan origination, scoring, and repayment tracking. Platforms like ABLE™ and HES LoanBox provide:

- Digital onboarding.

- Smart scoring modules.

- Borrower portals for online management.

- Compliance and reporting tools.

Customers can also apply for in-house financing online, making the process accessible from anywhere.

In-House Financing in Pakistan

In Pakistan, in-house financing is widely used in car dealerships, real estate projects, and retail appliances. Many businesses offer installment plans directly, making high-ticket items more affordable. With rising demand for flexible payments, in-house financing continues to grow across sectors like healthcare, education, and renewable energy.

FAQs

1. What is the meaning of in-house financing?

It means the seller provides the loan directly without involving banks.

2. What is an in-house loan?

An in-house loan is credit extended by a retailer or dealer to finance a purchase.

3. How does car in-house financing work?

The dealership lends part of the purchase price, and the customer repays in installments.

4. What are in-house financing requirements?

Proof of income, ID documents, and agreement to repayment terms.

5. Is in-house financing better than bank financing?

It depends. In-house financing offers speed and flexibility, while banks may provide lower interest rates.

Conclusion

In-house financing is a powerful tool for businesses and customers alike. It simplifies purchases, increases affordability, and strengthens customer loyalty. Whether you are exploring in-house financing examples in automotive, using in-house financing calculators, or adopting in-house financing software, this model offers flexibility and growth opportunities.

From in-house financing in Pakistan to global retail giants, the trend is clear: direct financing is reshaping how people buy cars, appliances, medical services, and more. Businesses that embrace in-house financing online and integrate smart software solutions will stay ahead in customer satisfaction and profitability.

“Live beautifully, feel Homedwellish.”